9 of the Biggest Financial Crimes in History

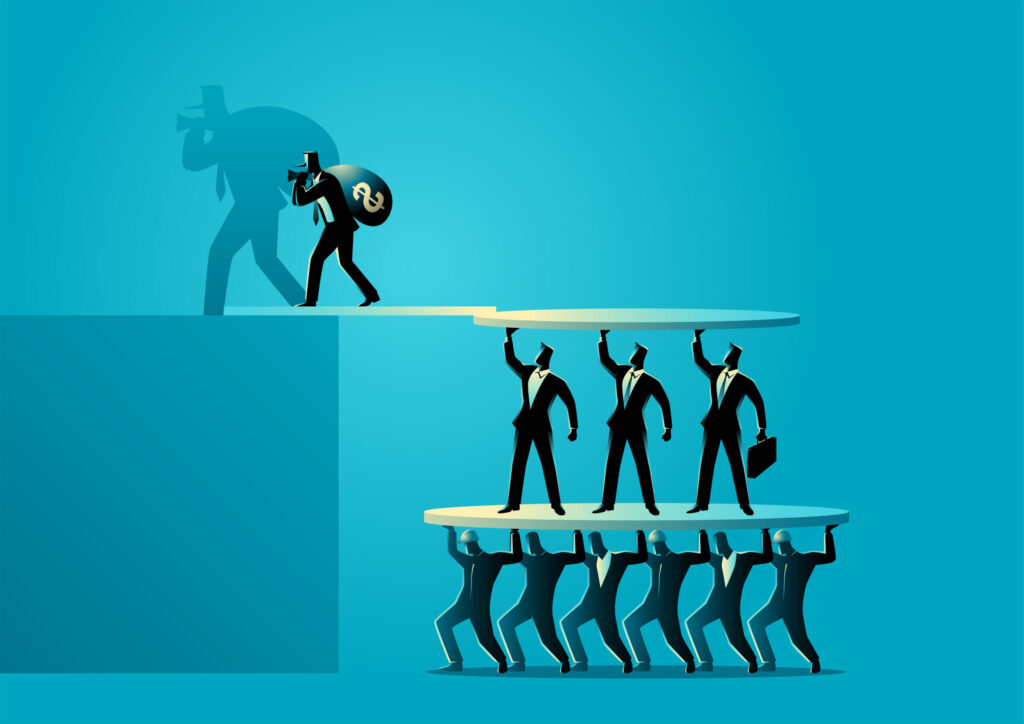

Financial crimes range from fraud to money laundering, from insider dealing and market abuse to corruption and bribery, and from electronic crime to terrorist financing. While financial crimes have always been a global threat, the last few decades have unearthed just how impactful these crimes can be on the global economy and its stability. Ponzi schemes often garner the most media attention, but the reality is that financial crimes of all kinds occur rampantly throughout the world and are committed by a wide range of people.

So, who is committing these financial crimes? In many cases it is an individual “working alone”. Yet, many corporate cases reveal a culture of corruption, exposing top executives who turn a blind eye or point fingers elsewhere. One of the commonalities that major financial crimes share is greed and an inflated sense of self. These perpetrators typically feel that they are smarter than FBI investigators, convincing themselves that they will be able to continue with their scheme indefinitely.

Nevertheless, these criminals typically get caught eventually. Their crimes, however, can have a significant impact long after the perpetrator is behind bars. The following are some of the biggest financial crimes in history:

- Bernie Madoff: he ran an enormous Ponzi scheme, the biggest financial fraud scandal in the history of the U.S.

- Charles Ponzi: where the term “Ponzi scheme” comes from, he ran his scheme for approximately a year in 1920

- Bruno Iksil: known as the “London Whale”, Iksil was a trader who worked for JPMorgan Chase whose fraud involved credit default swaps (CDS)

- Jordan Belfort: his story was made popular by the film The World of Wall Street, Belfort ran a penny-stock scam and engaged in stock market manipulation

- Nick Leeson: Leeson was a derivatives broker who caused the collapse of the United Kingdom’s oldest merchant bank (Barings Bank) via his fraudulent trades

- Jerome Kerviel: convicted of forgery, breach of trust, and unauthorized use of the bank’s computers, Kerviel was a French trader who accumulated losses reaching nearly $5 billion

- Allen Stanford: formerly the chairman of the Stanford Financial Group, he ran a huge Ponzi scheme that was revealed in 2009

- Bernie Ebbers: as the co-founder and former CEO of WorldCom, Ebbers fudged the company’s numbers to appear more valuable to investors and was sentenced to 25 years in prison

- Kenneth Lay: the CEO of Enron during their colossal-sized scandal, Lay was one of the leaders of the famous corruption and died before being sentenced

The financial sector is complex, opening the doors to potential fraud that is both difficult to prevent and detect. Understanding how some of the most notable financial crimes took place is a tactic to prevent future crimes from taking place. At Smith, Stohlman, James & Gardere, P.A., our staff includes five Certified Fraud Examiners who are involved in fraud detection and prevention engagements. Such engagements include evaluation of an organization’s internal controls, identification and measurement of frauds, and implementation of procedures that will reduce the risk of falling victim to fraud schemes in the future.

Past fraud engagements have resulted in successful recoveries in both civil and criminal actions. Contact our Orlando, Miami, or Palm Beach Gardens offices to speak with a fraud expert.