Posts Tagged ‘Fraud’

The OFE’s Role in Combating Tax Fraud

When it comes to the IRS, tax fraud is one of its biggest and most urgent concerns. Launched in 2020, the IRS established the Office of Fraud Enforcement (OFE) is order to focus more strategically on combating tax fraud. Fraud detection has long troubled the IRS, so the OFE serves to “promote compliance by strengthening…

Read MoreLessons Learned from the Enron Scandal

What Was the Enron Scandal? At one point in history, Enron was one of the most powerful companies in the United States. The Houston, Texas based energy company was applauded for its expansions and ambitious projects, earning the title of “America’s Most Innovative Company” by Fortune for six consecutive years between 1996 and 2001. In…

Read MoreCorporate Fraud Spike is Inevitable

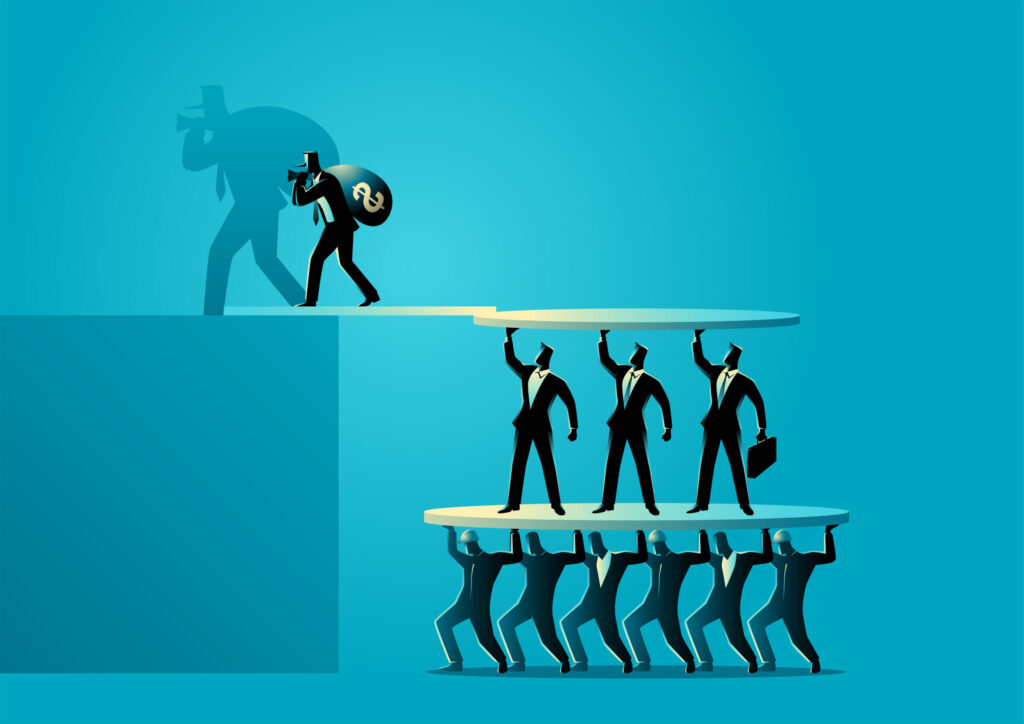

From financial statement fraud to cybercrimes, and many other types of fraud in between, 2021 and beyond is likely to see a rise in fraud reaching nearly every industry. The pandemic has laid the foundation for fraud to run rampant, creating an environment where fraudulent activity will increase due to a number of major factors:…

Read MoreProtecting Your Business from Fraud with Proper IT

No company, big or small, is completely immune from cyber security threats. This current day and age, marked by the booming popularity of e-commerce, means that business owners and individuals rely on computers for everyday communication, sales, banking and more. Unfortunately, fraud can hit small businesses much harder than large corporations. According to the Association…

Read MoreMost Common Types of Financial Crimes in the U.S.

In a broad sense, a financial crime is defined as any type of crime that results in financial benefit to the criminal(s) involved. Financial crimes are carried out by organizations or individuals who seek economic advancement via illegal tactics. Regulatory bodies throughout the world are constantly developing new strategies to fight financial crimes, but the…

Read MoreFraud Prevention Strategies for Your Business

While it may seem counterintuitive, small and medium sized businesses are far more exposed to the prospect of fraud than large organizations. Approximately 5 percent of annual revenue is lost to internal fraud each year, according to research from the Association of Certified Fraud Examiners (ACFE). Unfortunately, many businesses focus their fraud prevention efforts on…

Read More9 of the Biggest Financial Crimes in History

Financial crimes range from fraud to money laundering, from insider dealing and market abuse to corruption and bribery, and from electronic crime to terrorist financing. While financial crimes have always been a global threat, the last few decades have unearthed just how impactful these crimes can be on the global economy and its stability. Ponzi…

Read MoreThe Capacity for Fraud Amidst a Pandemic

In times of crisis and economic downturn, fraud tends to run rampant. Since COVID-19 began, the combination of health and financial threats laid the foundation for opportunistic fraudsters, those people who are looking to take advantage of a vulnerable market and a vulnerable population. From the global economy to individual lives, the pandemic has had…

Read MoreNew Forensic Accounting Landscape Amid a Pandemic

COVID-19 has presented challenges in every industry, in every country, throughout the world. As businesses and markets attempt to keep up with the inevitable and constant changes plaguing the globe, there are some clear winners and losers. Forensic accounting is one segment that is often benefitted during an economic downturn. With jobs scarce, markets disrupted,…

Read MoreStrategies to Prevent Small Business Fraud

While business fraud is prevalent amongst companies of all sizes, larger organizations are less susceptible to fraud compared to small and mid-sized businesses. On top of that, small and mid-sized businesses have a much tougher time recovering from fraud compared to large organizations. In fact, the ACFE (Association of Certified Fraud Examiners) conducted a recent…

Read More